Our Mortgage Broker Near Me Ideas

Wiki Article

Getting My Mortgage Broker In Scarborough To Work

Table of ContentsLittle Known Questions About Mortgage Broker.The 8-Minute Rule for Mortgage Broker ScarboroughScarborough Mortgage Broker Can Be Fun For AnyoneOur Mortgage Broker Scarborough PDFsHow Mortgage Broker In Scarborough can Save You Time, Stress, and Money.What Does Mortgage Broker In Scarborough Do?

What Is a Home loan Broker? The home mortgage broker will work with both celebrations to obtain the private accepted for the loan.A mortgage broker normally works with several different lending institutions and also can supply a range of lending options to the consumer they function with. The broker will certainly collect information from the individual and also go to numerous lending institutions in order to find the ideal prospective lending for their customer.

All-time Low Line: Do I Need A Home Mortgage Broker? Working with a mortgage broker can save the borrower time and effort throughout the application procedure, as well as potentially a great deal of cash over the life of the loan. In enhancement, some loan providers work solely with home loan brokers, implying that borrowers would have access to fundings that would otherwise not be available to them.

Rumored Buzz on Mortgage Broker Scarborough

It's essential to check out all the charges, both those you could need to pay the broker, as well as any type of costs the broker can help you stay clear of, when evaluating the choice to work with a mortgage broker.

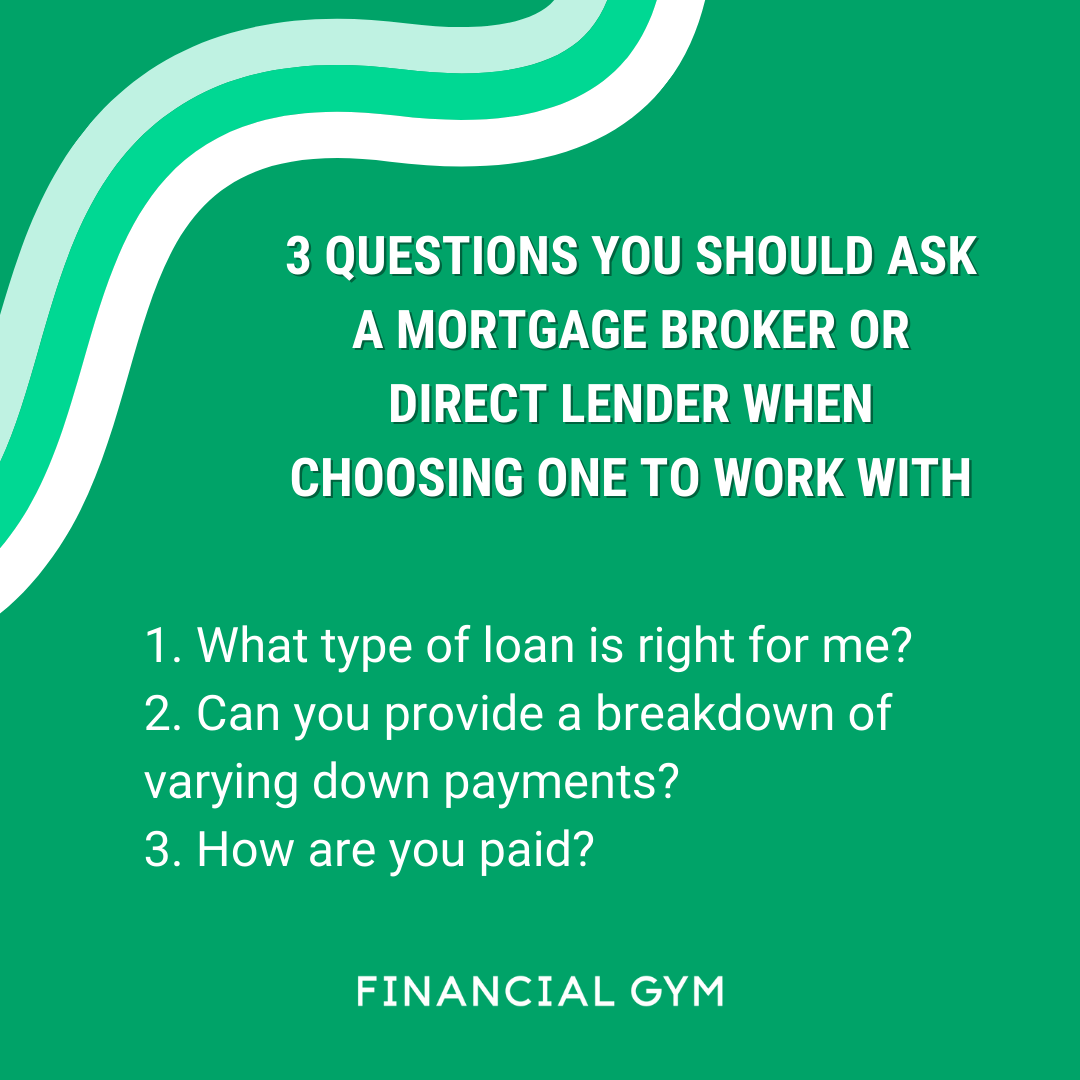

1. What is a home loan broker? A home loan broker acts as an intermediary in between you and possible lending institutions. The broker's job is to compare mortgage loan providers in your place and find rate of interest that fit your demands. Home mortgage brokers have stables of loan providers they deal with, which can make your life less complicated.

Mortgage Broker Scarborough for Beginners

Exactly how does a home mortgage broker get paid? Mortgage brokers are most frequently paid by lending institutions, in some cases by debtors, however, by law, never both.

Home mortgage brokers may be able to provide debtors access to a wide selection of financing kinds. 4. Is a mortgage broker right for me? You can save time by utilizing a home loan broker; it can take hours to make an application for preapproval with various lending institutions, then there's the back-and-forth interaction involved in financing the financing as well as guaranteeing the purchase remains on track.

Mortgage Broker Scarborough - Truths

Yet when choosing any kind of lender whether through a broker or directly you'll want to take notice of loan provider costs. Particularly, ask what charges will show up on Page 2 of your Lending Estimate form in the Lending Costs area under "A: Source Charges." Then, take the Funding Estimate you get from each lender, place why not try here them side-by-side as well as compare your rates of interest and also all of the costs as well as shutting costs.5. mortgage broker Scarborough. Exactly how do I choose a home loan broker? The most effective method is to ask close friends and family members for referrals, however ensure they have really used the broker and aren't simply dropping the name of a previous university roomie or a far-off associate. Discover all you can concerning the broker's solutions, communication design, level of understanding and strategy to customers.

Ask your agent for the names of a few brokers that they have functioned with and also discover here depend on. Some actual estate companies provide an in-house mortgage broker as part of their collection of services, but you're not obligated to go with that company or person.

Mortgage Broker In Scarborough Can Be Fun For Anyone

Likewise, read online evaluations as well as contact the Bbb to examine whether the broker you're considering has a sound online reputation. Frequently asked inquiries, What does a home loan broker do? A mortgage broker discovers lending institutions with lendings, rates, as well as click for info terms to fit your requirements. They do a great deal of the legwork throughout the mortgage application procedure, possibly saving you time.

Competition and home rates will certainly influence just how much home loan brokers make money. What's the difference between a home mortgage broker and also a lending policeman? Mortgage brokers will certainly work with several lending institutions to find the ideal loan for your scenario. Finance policemans function for one loan provider. Exactly how do I locate a mortgage broker? The finest way to locate a home loan broker is via referrals from household, friends and also your property representative.

Buying a brand-new residence is one of the most complicated occasions in an individual's life. Characteristic vary significantly in terms of style, features, institution area as well as, certainly, the constantly important "location, location, area." The home mortgage application process is a challenging element of the homebuying process, particularly for those without past experience - mortgage broker near me.

Getting My Mortgage Broker Scarborough To Work

Report this wiki page